“People want to be in traditional medicare vs this version.”So many people still think that Senior Care – the GHI/CBP plan that many retirees have and are trying to hold onto – is “traditional Medicare.” It’s not.

Traditional Medicare (Parts A and B) is run by the federal CMS with money from two trust funds – replenished by payroll taxes and Congressionally-authorized monies – and premiums (hhs.gov). As everyone knows, Medicare doesn’t cover all medical costs, far from it. There remain deductibles, copays and coinsurances, which are paid by the seniors themselves, or by their employers, a private insurance company, or the government. Even when people do buy a supplemental plan, they mostly still have to pay some things out of pocket.

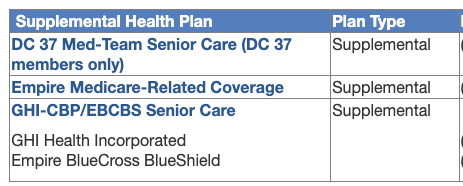

The OLR has been offering retirees a choice of such plans, the most popular of which, I guess, has been Senior Care GHI. In a lot of ways it acts like a private market plan (a Medigap), but the city has negotiated it to include a general medical deductible, a fee-structure for hospital stays, and copays – none of which exist in market Medigaps.

What the commenter is really saying is these retirees want to keep the supplemental Senior Care plan and not be shoved into an Advantage plan.

The next part of the comment is balderdash:

“In essence you are repeating what Mulgrew keeps claiming - aw shucks it’s still medicare and I wish we could just call it that instead of that badly misnamed Medicare Adv — Mulgrew would call it wonderful medicare.”Even if Mulgrew did say what’s being claimed here, it’s not worth all that much. He’s shown no deep comprehension of the way Medicare works or he’d have been explaining it better and cutting out all the PR. No one believed him when he said “We will continue to monitor its implementation” (The Gothamist): there are doctors who have still not heard about the new plan yet, and others are saying “Absolutely not, we’re not taking any Advantge plans.”

“I think you need to qualify the differences in how med and Medadv are administered.”that’s half right. I haven’t really spelled out in recent posts how billing works with Traditional Medicare.

Parenthetically, I’m pretty sure the newer scandals will at some point involve upcoding:Here’s what our new Aetna brochure on prior authorizations says you can expect from the plan, some of which is no surprise (like cosmetic and experimental services), but some are pretty scary for people who have serious conditions and are afraid of delays and outright denials:Upcoding occurs when a health care provider seeks reimbursement using a fraudulent CPT code that provides a higher reimbursement than the CPT code which corresponds to the services actually rendered to a Medicaid or Medicare patient.and in the Part D side of Medicare (stand-alone drug plans or drug components inside of Advantage plans), watch out for Pharmacy Benefit Managers (PBMs):

An example of upcoding would be if a doctor saw a patient for a routine check-up (which has a CPT code with a reimbursement of say $60), but when billing Medicare the doctor provides the CPT code for an extended check-up, which provides a reimbursement of $100. (Kohn, Kohn and Colapinto)Pharmacy Benefit Managers (PBMs) are third party companies that function as intermediaries between insurance providers and pharmaceutical manufacturers. PBMs create formularies, negotiate rebates (discounts paid by a drug manufacturer to a PBM) with manufacturers, process claims, create pharmacy networks, review drug utilization, and occasionally manage mail-order specialty pharmacies. In light of rising health care costs, the role of PBMs are being reviewed due to the cost of prescriptions drugs and the effects on consumers. (NAIC Center for Insurance Policy and Research)

Compare the above the list to the city’s Medicare Advantage Plus plan of 2019, which gave 32 (!) outpatient procedures needing prior authorizations. What might be considered “normal” senior outpatient services – like endoscopy – don’t seem to require prior auths in the new Aetna plan. I actually confirmed one or two of them by phone with Aetna a couple of weeks ago. The physicians will just book the procedure and that’s that.

Back to the comments:

Who ya gonna call when there’s a problem? Right now we call Medicare. After Sept 1 we call Aetna and their most probable non-unionized, lower paid and insentivized staff to help profit motive.Energetic, but not true. When there’s a billing problem, you don’t always have to call Medicare, and even with Advantage plans, a conversation with the doctor’s office and/or the company itself might find a coding issue, which can be fixed by correction and resubmission. Other times, the doctor has to supply more information, which annoys them no end, but the purpose is not always maniacal.

But there have been so many complaints about access to care that CMS had to act. Last April it issued a final rule that will take effect in 2024 to address these. Here are some main points relating specifically to medical prior authorizations in Advantage plans (choices and numbering mine):

The final rule clarifies clinical criteria guidelines to ensure people with MA receive access to the same medically necessary care they would receive in Traditional Medicare. Specifically, [1] CMS [requires that] MA plans must comply with national coverage determinations ... local coverage determinations ... and general coverage and benefit conditions included in Traditional Medicare regulations ... [2] when coverage criteria are not fully established, MA organizations may create internal coverage criteria based on current evidence in widely used treatment guidelines or clinical literature made publicly available to CMS, enrollees, and providers ... [3] streamlines prior authorization requirements, including adding continuity of care requirements and reducing disruptions for beneficiaries ... [4] all MA plans [are required to] establish a Utilization Management Committee to review policies annually and ensure consistency with Traditional Medicare’s national and local coverage decisions and guidelines ... [5] approval of a prior authorization request for a course of treatment must be valid for as long as medically reasonable and necessary to avoid disruptions in care in accordance with applicable coverage criteria, the patient’s medical history, and the treating provider’s recommendation.“The rules are designed to ensure people with MA plans get access to the same necessary care – prescriptions, medical tests, equipment, and procedures – they would receive in traditional Medicare” (Fortune.com).

For the rest of the comments left on yesterday’s post:

By the way, the GHI emblem plans we’ve had I am told is for a non-profit agency.I have never ever said Medicare Advantage is “just Medicare,” because I’ve always been a single-payer kind of girl and still wear my Bernie tee-shirt to prove it. But I do have things to say about for-profit and non-profit health insurance companies, and will save those for another day.

I also think to talk about how the money moves and the amounts Aetna gets from medicare to cover costs and profit. And that the admins of Medicare have nothing to gain personally compared to Aetna — say the person you deal with has employee stock options. So to blandly say Medicare Advantage is just medicare without qualifying comments is misleading.