“People want to be in traditional medicare vs this version.”So many people still think that Senior Care – the GHI/CBP plan that many retirees have and are trying to hold onto – is “traditional Medicare.” It’s not.

Traditional Medicare (Parts A and B) is run by the federal CMS with money from two trust funds – replenished by payroll taxes and Congressionally-authorized monies – and premiums (hhs.gov). As everyone knows, Medicare doesn’t cover all medical costs, far from it. There remain deductibles, copays and coinsurances, which are paid by the seniors themselves, or by their employers, a private insurance company, or the government. Even when people do buy a supplemental plan, they mostly still have to pay some things out of pocket.

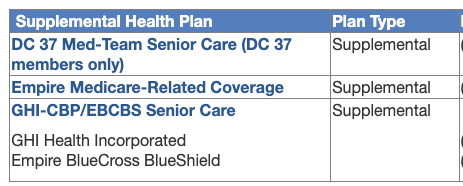

The OLR has been offering retirees a choice of such plans, the most popular of which, I guess, has been Senior Care GHI. In a lot of ways it acts like a private market plan (a Medigap), but the city has negotiated it to include a general medical deductible, a fee-structure for hospital stays, and copays – none of which exist in market Medigaps.

What the commenter is really saying is these retirees want to keep the supplemental Senior Care plan and not be shoved into an Advantage plan.

The next part of the comment is balderdash:

“In essence you are repeating what Mulgrew keeps claiming - aw shucks it’s still medicare and I wish we could just call it that instead of that badly misnamed Medicare Adv — Mulgrew would call it wonderful medicare.”Even if Mulgrew did say what’s being claimed here, it’s not worth all that much. He’s shown no deep comprehension of the way Medicare works or he’d have been explaining it better and cutting out all the PR. No one believed him when he said “We will continue to monitor its implementation” (The Gothamist): there are doctors who have still not heard about the new plan yet, and others are saying “Absolutely not, we’re not taking any Advantge plans.”

But where the commenter says:

Back to the comments:

But there have been so many complaints about access to care that CMS had to act. Last April it issued a final rule that will take effect in 2024 to address these. Here are some main points relating specifically to medical prior authorizations in Advantage plans (choices and numbering mine):

For the rest of the comments left on yesterday’s post:

“I think you need to qualify the differences in how med and Medadv are administered.”that’s half right. I haven’t really spelled out in recent posts how billing works with Traditional Medicare.

In the Traditional scenario, providers submit bills to Medicare for processing. According to Kaiser, “for most payment systems ... Medicare determines a base rate for a specified unit of service, and then makes adjustments based on patients’ clinical severity, selected policies, and geographic market area differences.” The remaining costs get forwarded to the supplemental plan, and the enrollee gets billed for what’s left to be paid. Prior authorizations virtually do not exist: this is mostly a fee-for-service situation.

I did touch on how Advantage plans work on my June 19th post, but I’ll be more specific here. Per capita amounts are sent to the Advantage plan companies (I said that), who design their own packages based on Medicare rules and government regulations (that too), but can deny coverage for certain services (and that in a different way). It’s these potential denials, based on a structure of prior authorizations in Advantage plans, but not in Traditional Medicare, that terrifies some retirees. (Not all retirees: me and some of my friends are in Advantage plans and have been getting the care we need.) But I acknowledge that the scandals surrounding Advantage plans have too frequently involved denials of coverage (for the reasons on the left, from DHHS, April 2022).

Parenthetically, I’m pretty sure the newer scandals will at some point involve upcoding:Here’s what our new Aetna brochure on prior authorizations says you can expect from the plan, some of which is no surprise (like cosmetic and experimental services), but some are pretty scary for people who have serious conditions and are afraid of delays and outright denials:Upcoding occurs when a health care provider seeks reimbursement using a fraudulent CPT code that provides a higher reimbursement than the CPT code which corresponds to the services actually rendered to a Medicaid or Medicare patient.and in the Part D side of Medicare (stand-alone drug plans or drug components inside of Advantage plans), watch out for Pharmacy Benefit Managers (PBMs):

An example of upcoding would be if a doctor saw a patient for a routine check-up (which has a CPT code with a reimbursement of say $60), but when billing Medicare the doctor provides the CPT code for an extended check-up, which provides a reimbursement of $100. (Kohn, Kohn and Colapinto)Pharmacy Benefit Managers (PBMs) are third party companies that function as intermediaries between insurance providers and pharmaceutical manufacturers. PBMs create formularies, negotiate rebates (discounts paid by a drug manufacturer to a PBM) with manufacturers, process claims, create pharmacy networks, review drug utilization, and occasionally manage mail-order specialty pharmacies. In light of rising health care costs, the role of PBMs are being reviewed due to the cost of prescriptions drugs and the effects on consumers. (NAIC Center for Insurance Policy and Research)

Compare the above the list to the city’s Medicare Advantage Plus plan of 2019, which gave 32 (!) outpatient procedures needing prior authorizations. What might be considered “normal” senior outpatient services – like endoscopy – don’t seem to require prior auths in the new Aetna plan. I actually confirmed one or two of them by phone with Aetna a couple of weeks ago. The physicians will just book the procedure and that’s that.

Back to the comments:

Who ya gonna call when there’s a problem? Right now we call Medicare. After Sept 1 we call Aetna and their most probable non-unionized, lower paid and insentivized staff to help profit motive.Energetic, but not true. When there’s a billing problem, you don’t always have to call Medicare, and even with Advantage plans, a conversation with the doctor’s office and/or the company itself might find a coding issue, which can be fixed by correction and resubmission. Other times, the doctor has to supply more information, which annoys them no end, but the purpose is not always maniacal.

I don’t know anything about “non-unionized, lower paid and insentivized staff” on the decision panels, and I’m sure the commenter doesn’t either. What I’m reading is that there are rules on who can authorize or deny: “The ultimate decision on a prior authorization request rests with a clinician — a physician or nurse — who works for the health plan to which the request was submitted. All final denials or redirects commonly are decided by a clinician at the insurance carrier.” Another report says the “prior authorization is then reviewed by clinical pharmacists, physicians, or nurses at the health insurance company. Somewhere else I read that any of these people can approve a procedure, but only physicians can deny one.

But there have been so many complaints about access to care that CMS had to act. Last April it issued a final rule that will take effect in 2024 to address these. Here are some main points relating specifically to medical prior authorizations in Advantage plans (choices and numbering mine):

The final rule clarifies clinical criteria guidelines to ensure people with MA receive access to the same medically necessary care they would receive in Traditional Medicare. Specifically, [1] CMS [requires that] MA plans must comply with national coverage determinations ... local coverage determinations ... and general coverage and benefit conditions included in Traditional Medicare regulations ... [2] when coverage criteria are not fully established, MA organizations may create internal coverage criteria based on current evidence in widely used treatment guidelines or clinical literature made publicly available to CMS, enrollees, and providers ... [3] streamlines prior authorization requirements, including adding continuity of care requirements and reducing disruptions for beneficiaries ... [4] all MA plans [are required to] establish a Utilization Management Committee to review policies annually and ensure consistency with Traditional Medicare’s national and local coverage decisions and guidelines ... [5] approval of a prior authorization request for a course of treatment must be valid for as long as medically reasonable and necessary to avoid disruptions in care in accordance with applicable coverage criteria, the patient’s medical history, and the treating provider’s recommendation.“The rules are designed to ensure people with MA plans get access to the same necessary care – prescriptions, medical tests, equipment, and procedures – they would receive in traditional Medicare” (Fortune.com).

For the rest of the comments left on yesterday’s post:

By the way, the GHI emblem plans we’ve had I am told is for a non-profit agency.I have never ever said Medicare Advantage is “just Medicare,” because I’ve always been a single-payer kind of girl and still wear my Bernie tee-shirt to prove it. But I do have things to say about for-profit and non-profit health insurance companies, and will save those for another day.

I also think to talk about how the money moves and the amounts Aetna gets from medicare to cover costs and profit. And that the admins of Medicare have nothing to gain personally compared to Aetna — say the person you deal with has employee stock options. So to blandly say Medicare Advantage is just medicare without qualifying comments is misleading.

What union represents CMS?

ReplyDeleteAFGE Local 1923 was chartered as a labor organization in October 1959, representing approximately 30,000 employees nationwide that are employed in the Social Security Administration, Centers for Medicare and Medicaid Services (formally HCFA), Veterans Affairs, Department of Defense, and the National Mediation Board.

Does Aetna, a CVS Health Company have a unionized workforce?

ReplyDeleteAsked January 21, 2022

2 answers

Answered July 11, 2022 - Analyst (Current Employee) - Hartford, CT

Aetna is not unionized.

Answered January 21, 2022 - Lpn (Former Employee) - Hartford, CT

No. They do not.

Nobody's questioning the profit motive of MAPS. I've said over and over gain I'm against health "insurance" of any kind. Health services should come out of a different income tax structure and the same kinds of public funds that give us roads, broadband, fire departments, police protections, and even the g...damn war machine. The point of this post and others planned is to do more research (for myself), and if anyone bothers to wade through these, help people sort out the current plans for themselves in their own health circumstances. If any of us want to join the protests and be activists – fine, but we still have to choose the health care arrangements for the current year. Having steeped myself in this turgid, miserable stuff as a retirement vocation for a decade, just passing along what I know. Doesn't mean I can't protest against privatization as well, just differently from the ways you guys have been doing it.

ReplyDeleteI was responding to this point you made: I don’t know anything about “non-unionized, lower paid and insentivized staff” on the decision panels, and I’m sure the commenter doesn’t either. - I actually do know about being in a union which is why civil service people are tested and also have a long term stake in the job vs fire at will Aetna -- do you think some employees who don't throw enough roadblocks in the way might get a talking too?

ReplyDeleteAm writing a follow-up post on prior auths now, but short answer. No: I don't think the problem comes from insentivized people performing roadblocks under threat and/or encourgement. From what I'm reading it's a procedural quagmire, and there's apparently some legislative and fixit efforts being made to clean some of this up. The industry acknowledges there's been too much underserving patients, and they're affected by studies, scandals, and press.

ReplyDelete